07/04/2021

07/04/2021

Non-oil GDP expected to grow 3.3% in 2021

KUWAIT CITY, April 7: Economic activity is estimated to have declined by 6.6% in 2020, refl ecting a drop in both non-oil GDP (roughly 70% of total GDP) by -5.1% on COVID-19 fallout and the oil sector by -8.5% due to OPEC+ production cuts. Total GDP contracted in 1H20 by 3.9% y/y as non-oil GDP fell by 6.0%, at a time where movement restrictions and health-related closures were more prevalent, hurting the hospitality, transportation, and wholesale and retail trade sectors (about 30% of GDP). The UAE has done extremely well on vaccinations, standing among the best worldwide performers while avoiding strict closures and curfews. Vaccination deployment, with more than half of the population (52%) covered by mid-March, boosts re-opening and reduces pressures on key sectors.

As such, the recovery in 2021 could come from a rebound in the tourism and hospitality sector, although the extent of this recovery hinges on global recovery. Non-oil GDP is expected to grow 3.3% in 2021 and 3.5%over the medium term, on average, benefiting from Expo 2020 and the recovery in global demand.Oil GDP could decline 2.9%in 2021 as oil production is expected to reach 2.7mb/d due to the OPEC+ agreement. In the medium term, oil GDP could grow by 5%as output cuts are eased and refining capacity are expanded (Ruwais and Jebel Ali refinery upgrades and BPGIC’s Phase 3), adding about 1.2 mb/d to refining capacity

Recovery and loose monetary policy should translate into higher credit growth

Monetary policy is expected to remain accommodative over 2021-23 in tandem with Fed policy, given the Dirham peg to the US dollar. This should also help a return to positive growth for private sector credit of 3.5% in 2021, after a decline of 2.2% in 2020. Total domestic credit is expected to grow by around 4.0% over the medium term, supported by credit demand from government-related firms, the stabilization in the real estate market, and the broader recovery in the non-oil sector. With modest increase in demand in 2021 and possible further decline in expat population and with it a fall in rents (34% weight in CPI basket),consumer price infl ation could remain slightly negative (-0.5%), compared with -2.1% in 2020. The fall in housing rents could start bottoming out this year, then gradually pick-up in 2022-23 as real estate oversupply issues ease. Infl ation is projected to hover around 1% over the medium term.

Fiscal and external balances seen returning to surplus

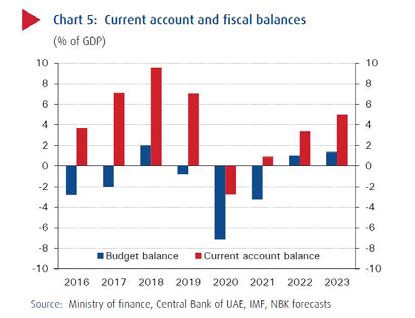

Large government stimulus packages with lower oil prices pushed the fiscal deficit to an estimated 7.1% of GDP in 2020. The fiscal and monetary support worth a combined 18% of GDP have helped in alleviating some of the pressures on the economy. Some of these measures aimed at reducing business costs through lowering/waiving fees, as well as supporting SMEs. The deficit, still reasonable by regional standards, should narrow to 3.3% of GDP in 2021 as spending is expected to fall across emirates by at least 5% on lower budgeted outlays by both federal and local governments.

Based on a recovery in oil prices to $60/bbl, the deficit could record a small surplus of 1% of GDP by 2022. (Chart 5.) Benefiting from low interest rates globally and a strong credit standing, UAE issued more debt in 2020 than before to finance the fiscal deficit. Abu Dhabi had the lion’s share at $15.1 billion benefiting from its extremely strong credit profile, while the Emirates of Dubai and Sharjah also issued around $2.0 billion. Yields for these bonds ranged from 0.75% to 4.0% with maturities from 3-50 years. Yet, the public debt to GDP (excl. GREs) remains relatively low at estimated38%, and is susceptible to decline in 2022-23 as the government benefits from expected oil prices and higher growth with the fiscal position returning to surplus in 2022-23.These same factors and expected pick up in external demand could lead to a recovery in tourism and should return the external current account to balance in 2021 and surplus in the following two years, after registering a deficit of -2.8% of GDP in 2020.

Positive outlook though uncertain

The UAE’s status as an international hub for trade, travel and tourism mean that it would stand to benefit from arapid global economic recovery.A successful Expo 2020 along with continued policy agility that responds to developments in a timely manner could have a lasting positive impact on the economy and increase its resilience. On the downside, a possible reversal of US monetary policy sooner than expected due to infl ation concerns in addition to slow global growth along with renewed weakness in oil pricesand lingering government-related entity contingent liabilities could hinder growth prospects.