20/07/2022

20/07/2022

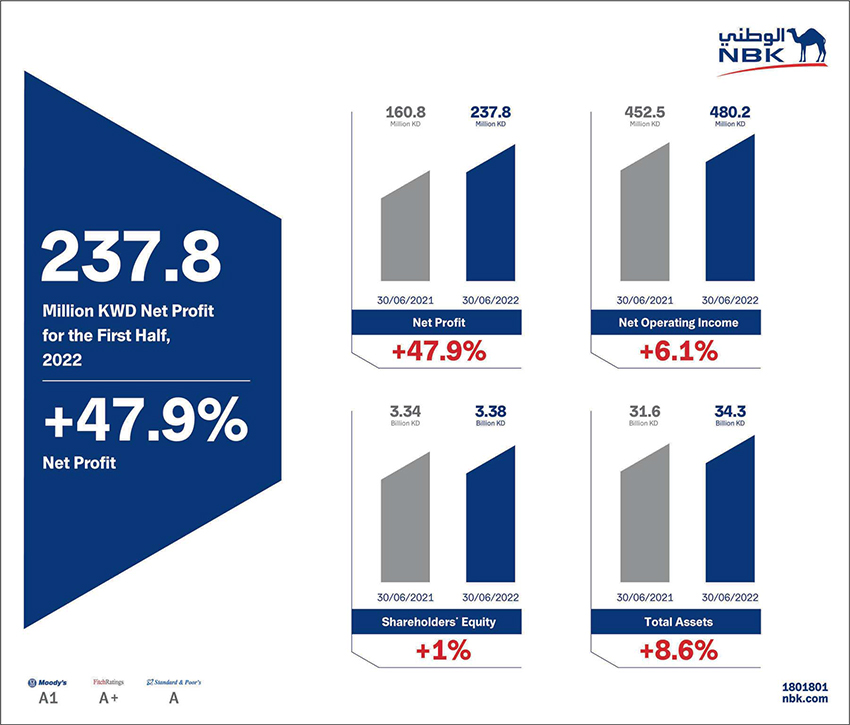

KUWAIT CITY, July 20: National Bank of Kuwait (“NBK”, the “Bank” or the “Group”) has announced its financial results for the six-month period ended 30 June 2022. The Bank reported a net profit of KD 237.8 million (USD 775.4 million), compared to KD 160.8 million (USD 524.2 million) for the same period in 2021, improving by 47.9% year-on-year. Net profit for the three-month period ended 30 June 2022 reached KD 121.2 million (USD 395.3 million), a year-on-year increase of 58.6% from the comparable period in 2021. Total assets as of end of June 2022 grew by 8.6% year-on-year to reach KD 34.3 billion (USD 111.8 billion), whereas total loans and advances increased by 8.8% year-on-year to KD 20.1 billion (USD 65.7 billion), and total shareholders’ equity reached KD 3.4 billion (USD 11.0 billion), growing by 1.0% year-on-year. NBK Board of Directors approved the distribution of 10% semi-annual cash dividends (10 fils per share) for the period ended June 2022.

This marks a historical milestone for NBK as the first semi-annual dividend distribution post the General Assembly approval on the amendment of Articles of the Memorandum and Articles of Association of the Bank with regards to dividends distribution.

Commenting on the Bank’s 1H 2022 financial results, Isam Al-Sager, Vice-Chairman and Group Chief Executive Officer, said: “NBK continued its growth momentum by recording yet another period of robust performance during 1H 2022; buoyed by the economic recovery and normalization of business activities post-pandemic. We are pleased to demonstrate on the success of our diversification strategy, fl exible business model, prudent risk management, robust capital, alongside our prosperous investments in technology and talent acquisition in delivering the Bank’s objectives.” Al-Sager added that:“The continuity of growth trends across strategic markets and segments, including Wealth Management and Islamic banking, asserts the sound financial position of the Group and its ability to generate income from diverse streams.

The Bank delivered a healthy growth of 6.1% in operating income, reaching KD 480.2 million, supported by core banking activity; while the lower cost of risk levels contributed positively in uplifting our bottom line profits.” “Thanks to the accelerated pace in executing the Group’s digital agenda, we continued to proactively respond to market needs through offering a wide range of products and services; upscaling our customers’ experience, satisfaction and retention.We believe that our achievements have put the Bank in a position of digital leadership domestically and regionally”, Al-Sager highlighted “The Bank will continue to invest heavily in its strategic initiatives to ensure maximized returns for its stakeholders and contribute positively to its communities. Leveraging on the Group’s resilience and its ability to continue to grow and progress, NBK is entering the second half of the year with a stronger momentum and will continue to preserve its position as a leading regional bank. Our diversification strategy, international presence, strong financial position alongside our unique talent and organizational culture, are key differentiators in supporting the Bank to meet its objectives and maximize shareholder returns.”

“NBK’s Board of Directors has approved the distribution of semi-annual dividends. This demonstrates NBK’s solid capital adequacy, confidence in its financial position and its ability to generate profits”,Al-Sager stated.

Al Sager also stated: “The Group continues to focus on embedding sustainable practices within its operations. We are working tirelessly and across all our network of subsidiaries and branches to lower our operational GHG emissions and promote more sustainable practices. During the second quarter, we announced our plan to accelerate our efforts of transitioning our branches in Kuwait to become more environment friendly and increasing its dependence on renewable energy. This comes in line with our announced targets to reduce our operational emissions by 25% by 2025 and taking a more active role in global efforts of transitioning to a low carbon economy.”

“We take pride in the progress of the ranking that the Bank achieved in The Banker’s ‘Top 1000 World Banks’ and in remaining Kuwait’s pioneer; a further endorsement to the trust in our brand position. Likewise, Weyay, Kuwait’s first digital bank, received ‘Outstanding Innovation in Mobile Banking’ award in Global Finance’s annual Innovators Awards for 2022; testifying the prominent role of our digital investment in being growth streams in the short-to-medium term,”Al-Sager asserted