15/05/2024

15/05/2024

Kuwait City, May 15: Building on the pivotal role of embedding sustainability principles in society, Gulf Bank has announced its ambitious Environmental, Social, and Governance (ESG) spanning from 2024 to 2030. This strategy will serve as a roadmap and a clear structural plan for the next six years.

On this occasion, the Acting CEO of Gulf Bank, Mr. Waleed Khaled Mandani, stated, "At Gulf Bank, our commitment to environmental, social, and governance principles is foundational to who we are. It highlights our dedication to fostering a sustainable future, not just within our organization, but also in the broader community. This is a reflection of our aspirations to be a leading banking institution in Kuwait."

Mr. Mandani pointed out that the strategy establishes specific goals for implementing measurable sustainability standards and key performance indicators. This will lead to the adoption of selected high-quality initiatives, aimed at boosting environmental and social sustainability as well as corporate governance. These initiatives are designed to reflect our core values and guide every aspect of our banking practices and operations.

He added, "We believe that implementing ESG standards is essential for our long-term success and achieving our 2030 strategy will stand as a testament to our dedication to making a positive impact on society. Aligning our values and business objectives with ESG principles assists us in conducting responsible banking practices, empowering various social groups, and maintaining a fair work environment."

Mr. Mandani further explained, "Our 2030 ESG standards extend beyond mere financial metrics, to ensure that Gulf Bank's practices, procedures, and decisions align with the wider community and environmental obligations and adhere to the highest standards in the banking industry, as well as local regulations."

He emphasized that the bank's success and continued growth depend on integrating environmental, social, and governance considerations – governed by a clearly defined comprehensive strategy that aligns with the bank's values, shareholders, and customers.

The General Framework

On his part, Mr. Meshal Al-Wazzan, Head of Strategy at Gulf Bank, highlighted the general framework and broad outlines of the Environmental, Social, and Governance (ESG) strategy for the year 2030, which are as follows:

- Regulatory Compliance

The strategy is designed to ensure Gulf Bank adheres to local laws and regulations regarding sustainability and responsible business practices. Additionally, it seeks to showcase the bank's ability to compete by aligning with the industry's best practices and adapting to emerging standards.

- Sustainable Value

The strategy is designed to enhance the bank's role in contributing to reducing negative environmental impacts while empowering customers, shareholders, and the community. This approach preserves sustainable value, which is advantageous to both the bank and its partners.

- Performance Accountability

ESG governance standards will serve as a comprehensive mechanism enabling the bank to measure and monitor its performance and progress in achieving its goals. This will be achieved through measurable actions and objectives that make Gulf Bank a leading example in defining and clarifying responsibilities.

- Risk Management

Gulf Bank recognizes that environmental, social, and governance factors present both risks and opportunities. The ESG 2030 standards are designed to efficiently identify, assess, reduce, and manage these risks, ensuring the bank is safeguarded against potential threats to its reputation, operational integrity, and ongoing viability.

- Engagement of Customers, Shareholders, and Stakeholders

The strategy encourages collaboration and engagement among the bank, its shareholders, customers, and both internal and external stakeholders, aiming to achieve specific environmental, social, and governance objectives. It also showcases the bank's commitment to transparency and ensures that actions are taken to address the expectations and concerns of all involved parties effectively.

Mr. Al-Wazzan further stated: "To advance the implementation of our strategy, we must adopt a comprehensive and dynamic approach that ensures our strategic goals and commitments are aligned with the board of directors' overarching vision. This approach should also take into account evolving regulatory frameworks, emerging risks related to environmental, social, and governance issues, and the growing expectations of shareholders and customers."

The bank emphasized its commitment to reducing its impact on the surrounding environment, making sufficient efforts to decrease carbon emissions, optimizing resource usage, responsibly managing waste, and addressing all other environmental risks.

Bank Officials Commit to ESG Principles for a Sustainable Future

Furthermore, several bank officials affirmed their commitment to driving positive change by aligning their business objectives with the principles of environmental, social, and governance (ESG) outlined in the strategy. They view these principles as a proactive mechanism to support the bank's values and achieve its vision for a sustainable future. The officials emphasized that the bank's responsible banking practices significantly contribute to the overall well-being of society, while also specifically benefiting shareholders and customers.

They stated: "We recognize that fulfilling our environmental, social, and governance (ESG) commitments requires collective effort and collaboration from various bank departments and employees, as well as engaging with shareholders, customers, and stakeholders. By seeking their feedback, we can collectively continue our journey toward a more sustainable future.

Enhancing Gulf Bank's Leadership in Sustainable Innovation

Mr. Mohammad Al-Qattan, the General Manager of Consumer Banking at Gulf Bank, stated: "Our goal is to reinforce Gulf Bank's position as a leader in offering innovative services to our shareholders, customers, and stakeholders that foster sustainable growth. We are committed to utilizing technology and innovation to improve the experiences of our individual and small to medium-sized business clients, simplifying their access to our services. Furthermore, we are devoted to implementing environmentally friendly practices throughout all our branches and operations."

Human Resources

Ms. Salma Al-Hajjaj, the General Manager of Human Resources at Gulf Bank, emphasized the importance of continuing to establish fair work practices, achieving diversity and inclusion, empowering women, youth, and people with disabilities, and providing exceptional training. These initiatives help create an ideal workplace, boost employee well-being, and enhance their productivity and personal growth, while ensuring a harmonious balance between their professional and social lives.

Corporate Banking Services

Mr. Faisal Al-Adsani, the General Manager of Corporate Banking at Gulf Bank, stated: "We are dedicated to incorporating environmental, social, and governance (ESG) standards into our offerings by providing financing solutions that support sustainable projects advantageous to both the environment and climate. Moreover, we will focus on high-value sectors and improve access to financing for small and medium-sized enterprises."

Risk Management

Mr. Abdulrahman Al-Saddah, the Acting Chief Risk Officer at Gulf Bank, stated: "We are dedicated to adhering to the Capital Markets Authority regulations by integrating sustainability factors into our risk management processes and incorporating sustainability risks into the board of directors' roles and responsibilities. We also comply with the Central Bank of Kuwait’s guidelines that establish standards for evaluating climate-related risks. Our goal is to promote financing for projects that positively impact and address climate change, as well as to analyze and assess how ESG standards affect the bank's performance and financial stability. Additionally, we are evaluating climate-related risks.

Additionally, we are dedicated to advancing sustainable development goals that involve integrating climate change initiatives into national policies, strategies, and planning. This commitment includes improving educational initiatives, increasing awareness, and building both human and institutional capacities to tackle climate change through mitigation, adaptation, and reduction of its impacts. Additionally, we are focusing on strengthening early warning systems and ensuring our activities are in line with the first pillar of Kuwait's Vision.

Enhancing Community and Cybersecurity Through Sustainable Initiatives

Ms. Najla Al-Eisa, Chief Marketing Officer at Gulf Bank, stated: "Our primary focus is on supporting community initiatives that instill principles of sustainability within society. We achieve this by sponsoring and organizing a variety of events that promote environmental and social sustainability, and by empowering women and youth. Additionally, we conduct banking awareness campaigns that educate our customers about essential banking services, enhance their ability to conduct transactions securely, and ensure transaction safety. We also advocate for financial inclusion and economic stability by providing comprehensive education on customers' rights and responsibilities, informing them about the benefits of electronic financial transactions, and teaching them how to mitigate associated risks, all with the goal of enhancing cybersecurity."

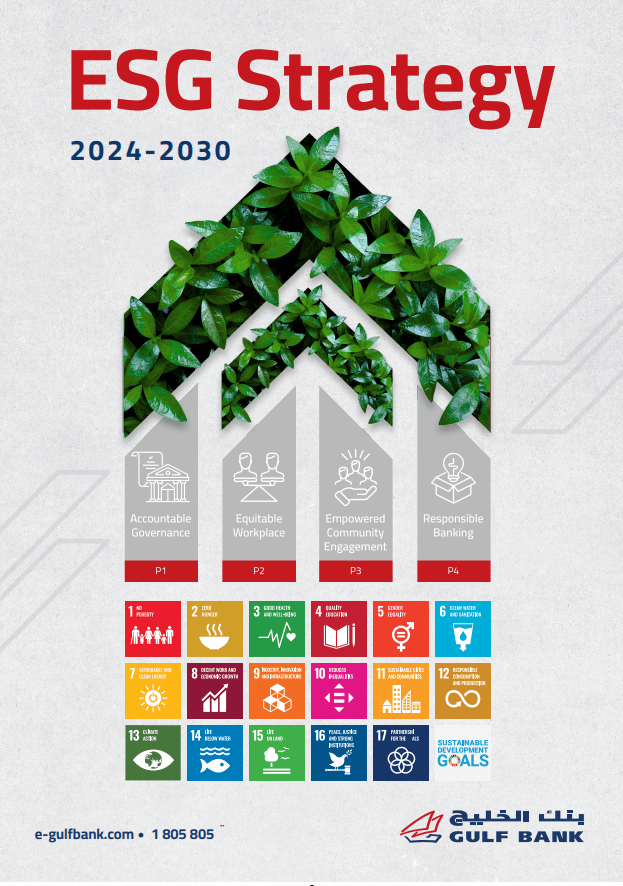

Four Pillars of the 2030 Sustainability Strategy

The key pillars of the bank’s 2030 strategy are as follows:

- Responsible Governance

- Fair Work Environment

- Community Engagement

- Banking Responsibility

These are in alignment with Kuwait's Vision, the Central Bank, the Capital Markets Authority, and the Sustainable Development Goals.

Mr. Al-Wazzan further noted that aligning Gulf Bank's strategy with the Sustainable Development Goals, the regulations of the Capital Markets Authority, the guidelines of the Central Bank of Kuwait, and Kuwait's new vision boosts the bank's reputation. It ensures adherence to regulatory standards, strengthens financial stability, provides access to capital markets, and fosters significant community engagement. This cements Gulf Bank's status as a forward-thinking bank and establishes a foundation for ongoing success in a dynamic business environment.

ESG 2030 Strategy Presentation

Mr. Al-Wazzan presented Gulf Bank's ESG 2030 strategy, focusing on environmental, social, and corporate governance, at a high-level seminar. This seminar was organized by the European Union Mission in Kuwait, in collaboration with the Kuwait Chamber of Commerce and Industry and the International Labour Organization. Titled "Supporting a Just Transition Towards a Greener Economy in Kuwait: The Role of the Private Sector," the seminar explored the private sector's role in developing effective strategies and providing sustainable financing to support a fair transition to a sustainable society and a greener economy.