The economy will return to expansion in 2025 led by the unwinding of earlier cuts in oil production. Non-oil GDP could grow slightly faster than in 2024 at 2.6%, amid interest rate cuts and signs that consumer spending growth and other metrics are edging higher. Structural reform prospects have improved, but strong delivery is needed for growth to sustainably match that in some other parts of the GCC. Fiscal deficits will continue through 2025, making another tight spending round likely next year although capex could still rise from recent very low levels.Key upside risks to the outlook include higher oil prices and clear signs of momentum on structural reforms.

Economy to return to growth over forecast period

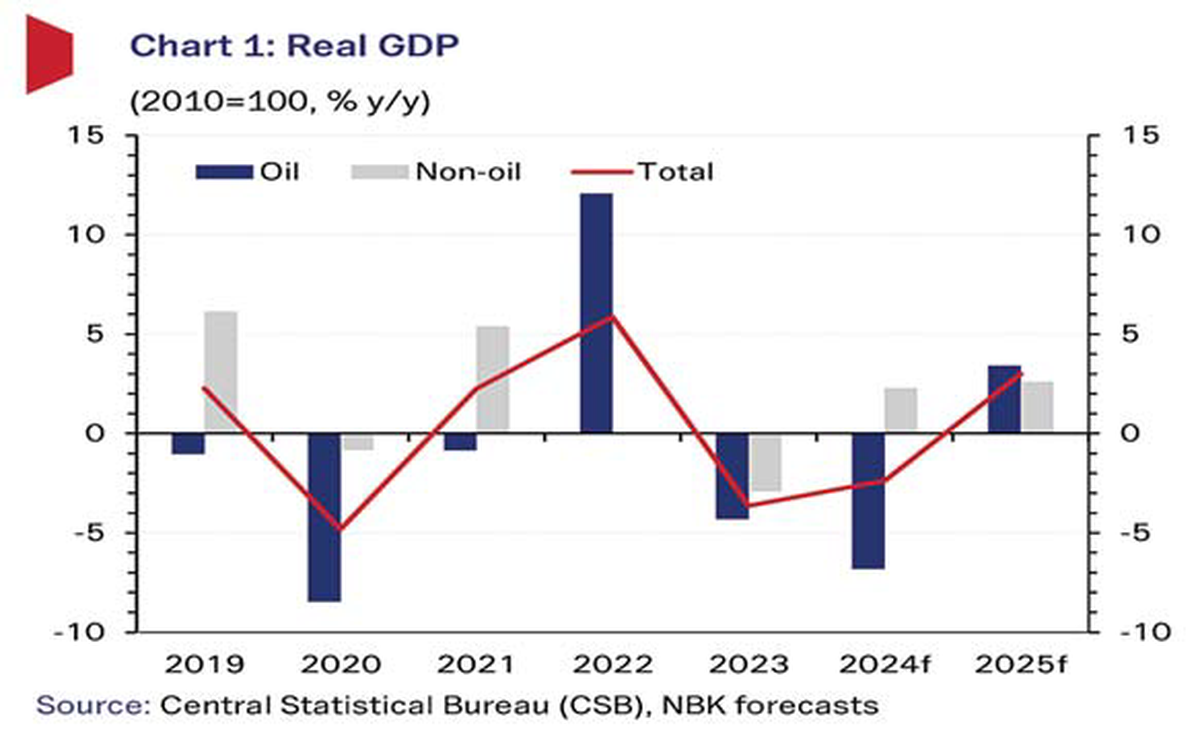

Kuwait’s non-oil economy is expected to emerge from two years of negative growth this year, expanding by 2.3% and then 2.6% in 2025. Having decelerated previously, consumer spending growth (+5.4% y/y in Q2) appears to have stabilized while other key indicators such as bank credit (+2.2% ytd in August), real estate sales (+24% y/y in Q3) and project awards have moved up, suggesting that a growth improvement could be around the corner. Official data (subject to revision) shows non-oil GDP growth averaging 3.5% in H1 2024, with manufacturing (mostly refining) the standout performer following the production ramp-up at the huge 615 kb/d Al-Zour refinery in 2023.

Despite the prospect of a cyclical upturn, our forecasts for non-oil growth are below the 2011-2019 historical average (+3.3%), with key structural challenges laying ahead. These include tackling low investment rates, the need for fiscal consolidation (see below) and Kuwait’s low rankings in competitiveness measures versus GCC peers. We do expect greater progress on these issues going forward than in previous years, reflecting more streamlined decision making in the new political climate.

The government is yet to release its work agenda for the years ahead and a step change in the pace of reform delivery is needed if Kuwait is to sustainably match the 4%+ non-oil growth rates now being recorded in Saudi Arabia and the UAE. We see strong expansion potential in sectors such as utilities, housing, transport, and tourism & entertainment over coming years. The oil sector is expected to record its first output gains in two years in 2025, with OPEC+ scheduled to unwind members’ voluntary cuts from end-2024. Kuwait should see 135 kb/d of crude return and production average 2.5 mb/d in 2025.

This should boost oil GDP by 3.4% from -6.8% in 2024 and total GDP growth to 3.0% in 2025 from -2.4% in 2024. State oil firm KPC is undergoing a restructuring aimed at delivering efficiency gains and faster decision-making but plans to spend some $410bn to achieve its 4 mb/d 2035 oil production target and 2050 net zero goal. Inflation down, monetary policy easing cycle begins.

Inflation has proven slightly sticky amid price rises in the food and clothing categories especially, but still eased to 2.9% y/y by August from 3.3% at the start of 2024. We see the trajectory as broadly downwards given moderate economic growth, still elevated interest rates and soft price. trends elsewhere in the GCC region: we see it slowing from 3.0% this year to 2.5% in 2025.

Meanwhile, the Central Bank of Kuwait cut its discount rate in September by 25 bps to 4.0%, after the US Fed cut interest rates by 50bps. This comes after the Central Bank of Kuwait had raised interest rates less than the US Fed during the recent tightening cycle. Deficits expected, fiscal consolidation to proceed Addressing the weak fiscal position is a key government objective, with deficits recorded in 8 of the past 9 years and forecast to average 5% of GDP in FY24/25-FY25/26. Issues include the rigid structure of public spending, especially the rising share of salaries and subsidies, and heavy reliance on oil revenues, which are forecast to decline in FY25/26 on lower average oil prices.

We expect another tight spending round in FY25/26, following a projected 5% spending cut this year (from FY23/24’s high base, inflated by one-off items), although potentially allowing for a pick-up in capex from recent very low levels as the authorities move on delayed infrastructure projects (e.g. housing, water, power). To boost fiscal sustainability, the IMF in its October Article IV statement recommended the government adopt a medium-term fiscal framework based on annual consolidation of 1-2% of GDP (up to KD950mn).

Steps would include caps in public sector hiring and wage control, energy subsidy cuts and the introduction of VAT, but higher investment. Still, ample fiscal and external buffers (estimated KIA assets of $980bn) including ultra-low debt levels (2.8% of GDP) put Kuwait in the enviable position of being able to balance reform of public finances with support for economic growth – so long as near-term liquidity pressures are avoided. Fitch recently reaffirmed Kuwait’s high investment grade AA- credit rating.

Oil, geopolitics and reform agenda the main outlook risks The main risks to the outlook center on the path of oil prices, reflecting the health of the global and Chinese economy in particular, regional geopolitical and security issues and progress on the government’s domestic reform agenda.

While oil prices could fall further than forecast and a widening regional conflagration cannot be discounted (which could lead to a spike in oil prices), we see the launch and implementation of a reform- centered economic plan as critical for driving a more positive growth narrative for Kuwait from 2025 onwards.

By National Bank of Kuwait