21/04/2022

21/04/2022

TOTAL ASSETS RISE 1.7% TO KD 22.2 BILLION

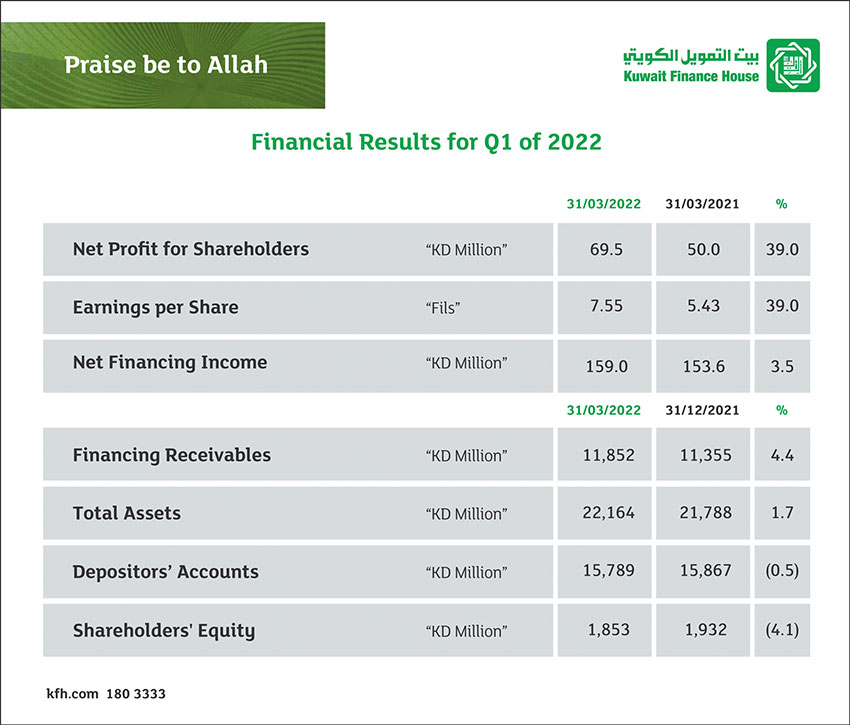

KUWAIT CITY, April 21: Chairman of Kuwait Finance House (KFH) Hamad Abdulmohsen Al-Marzouq said that KFH has, by the grace of Allah, reported net profit of KD 69.5 million for the first quarter of 2022 for KFH shareholders; an increase of 39.0% compared to the same period last year. Earnings per share for the first quarter of 2022 reached 7.55 fils; an increase of 39.0% compared to the same period last year. Net financing income for the first quarter of the year reached KD 159.0 million; an increase of 3.5% compared to the same period last year.

Financing receivables of the end of the first quarter of 2022 reached KD 11.9 billion, i.e. an increase of KD 496.5 million or 4.4% compared to end of year 2021. Investment in Sukuk as of the end of the first quarter of 2022 reached KD 3.0 billion; an increase of KD 228.6 million or 8.4% compared to end of year 2021. Total assets as of the end of the first quarter of 2022 reached KD 22.2 billion i.e., increase of KD 375.3 million or 1.7% compared to end of year 2021. Depositors’ accounts as of the end of the first quarter of 2022 reached KD 15.8 billion. Shareholders’ equity as of the end of the first quarter of 2022 reached KD 1.9 billion. In addition, the capital adequacy ratio reached 17.77% which is above the minimum limit required by regulators. This ratio confirms the solid financial position of KFH.

Solid financial results Al Marzouq added that KFH has successfully achieved solid financial results and growth in all key financial indicators for the fiscal first quarter 2022 despite local and global economic challenges. This emphasizes the effi- cient strategy and plans set up by KFH. He explained that KFH maintained remarkable ratios in terms of ROA, ROE, optimization, maximizing profitability, improving asset quality ratiosas well as the coverage ratio of provisions for non-performing debt. He noted that the KFH`s competitive performance on Group level attracted more customers and investors.

Digitization and ESG Al Marzouq emphasized that KFH is moving forward with digital transformation efforts and offering unique digital fi- nancial solutions that exceed customers’ expectations. He highlighted the pioneering role of KFH in leading the Islamic finance industry by offering innovative products and services, improving economic environment, supporting sustainability through promoting investment in Green Sukuk while observing ESG factors in line with KFH strategy in this regard.

Development support Al Marzouq said that, as part of its pioneering national role, KFH is keen on promoting and financing government development projects as well as offering wide range of retail, corporate and SME banking and financing solutions. He added that KFH has a specialized professional banking management, providing full financing services to such a promising segment.

Strong operational performance Meanwhile, the Acting Group Chief Executive Officer at KFH, Abdulwahab Essa Al Rushood said that the first-quarter 2022 profits confirm KFH`s continuous efforts to maximize profitability and ROE, maintain strong operational performance, continue the strategy of focusing on core banking as well as expanding its investment and business activities in Primary and Secondary Capital Markets. He explained that KFH’s profitability will improve in 2022 owing to continuous growth and higher business volumes from the recovery in the domestic economy and the discount rate increased by CBK.

Group subsidiaries Al Rushood emphasized that KFH enjoys high liquidity ratios, creditworthiness and diversified financing portfolio that support its business growth and raise the investment and financial capabilities of the Bank in Kuwait and the countries where Group subsidiaries operate (Turkey, Bahrain, Germany, Malaysia and Saudi Arabia). He noted that KFH is the largest Islamic bankin Kuwait and the second-largest bank overall, with a market share of 22.4% by local assets at end-2021.

Millions in contributions to social initiatives Al Rushood said that KFH proved its CSR leadership through millions in contributions to many strategic societal initiatives, adding that KFH signed agreements with Kuwait Red Crescent Society to execute several relief, medical, humanitarian and societal projects inside and outside Kuwait. He noted that KFH won “Corporate Social Responsibility in the Middle East” Award from the prestigious EMEA Finance magazine. Al Rushood said that KFH received “World’s Best Islamic Financial Institution 2022” award from Global Finance Group in recognition of its contributions to the growth of Islamic Finance, usage of technological innovation in providing services and the quality of product, reputation, customer satisfaction and compliance with ethical standards and strategic relations. In conclusion, Al Rushood expressed his appreciation for the trust of shareholders and customers and the support of the Board of Directors and thanked the regulatory authorities, praising the efforts of employees and all partners and stakeholders.