27/07/2022

27/07/2022

Earnings per share for first half of 2022 reaches 14.55 Fils

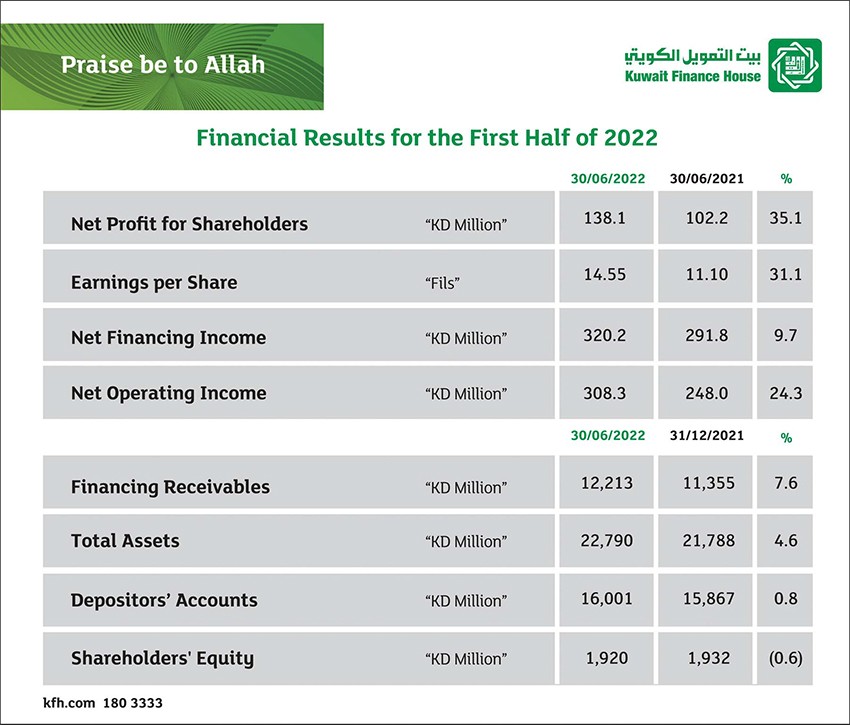

KUWAIT CITY, July 27: Chairman of Kuwait Finance House (KFH) Hamad Abdulmohsen Al Marzouq said that KFH has, by the grace of Allah, reported net profit of KD 138.1 million for the first half of 2022 for KFH shareholders; an increase of 35.1% compared to the same period last year. Earnings per share for the first half of 2022 reached 14.55 fils; an increase of 31.1% compared to the same period last year. Net financing income for the first half of the year reached KD 320.2 million; an increase of 9.7% compared to the same period last year. Net operating income for the first half of the year reached KD 308.3 million; an increase of 24.3% compared to the same period last year.

The cost to income ratio also improved, to reach 32.6% compared to 38.0% for the same period last year, driven by an increase in total operating income and a decrease in total operating expenses during the period. Financing receivables as of the end of the first half of 2022 reached KD 12.2 billion, i.e., an increase of KD 858 million or 7.6% compared to end of year 2021. Investment in Sukuk as of the end of the first half of 2022 reached KD 2.9 billion; an increase of KD 204 million or 7.5% compared to end of year 2021. Total assets as of the end of the first half of 2022 reached KD 22.8 billion i.e., increase of KD 1 billion or 4.6% compared to end of year 2021. Depositors’ accounts as of the end of the first half of 2022 reached KD16 billion i.e., increase of KD 134 million or 0.8% compared to end of year 2021. Shareholders’ equity as of the end of the first half of 2022 reached KD 1.9 billion. In addition, the capital adequacy ratio reached 17.74% which is above the minimum limit required by regulators. This ratio confirms the solid financial position of KFH.

Solid financial results

Al Marzouq added that KFH has successfully achieved solid financial results and growth in all key financial indicators for the fiscal first half 2022 despite local and global economic challenges. This emphasizes KFH’s prudent management, its efficient strategy, and its business methodology based on enhancing the leading position KFH enjoys in Kuwait and the markets it operates in, as well as on providing high-quality services, products and financial solutions on a par with the highest industry standards. He explained that KFH maintained remarkable ratios in terms of ROA, ROE, optimization, maximizing profitability, improving asset quality ratios as well as the coverage ratio of provisions for non-performing debt. He noted that KFH enjoys high liquidity ratios and solid capital base that support business growth.

The bank of future Al Marzouq said that by conducting stress tests according to strict scenarios, KFH proved the success of its risk management strategy in general during the previous period. This has helped KFH in expanding the range of solutions against any sudden challenge, reducing risks and exposures. Also, the prudent conditions applied by KFH in granting financing allowed it to be more capable of determining the quality of its current and potential customers, having growing confidence in weathering challenges and benefiting from future opportunities as well as dealing with exposures to financing risk. He added: ”Under the umbrella of its digital strategy and proactive approach that is based on innovation and comprehensive credit assessments, KFH deserves to be named the “Bank of Future” because of its strategy that enables it to meet future challenges and opportunities.”

As a future strategy, Al Marzouq pointed out that KFH increasingly invests in technology by adopting the latest innovations in FinTech, using AI, and providing unique mobile banking services. This could drive the digital development in the industry and successfully activate business continuity plan, if needed. He explained that KFH seeks to deepen its role in SMEs sector and in supporting youth, as they are one of the sustainability elements and one of the most prominent pillars of KFH strategy during the coming period. In doing this, KFH will enhance its leadership position in the market.

Leadership and excellence Meanwhile, the Acting Group Chief Executive Officer at KFH, Abdulwahab Essa Al Rushood said that the first-half 2022 profits confirm KFH’s strong standing and allow it to benefit from the strong growth in consumer finance and expected rise in awarding projects. “Along with the strong credit quality it enjoys, KFH continues its efforts to maximize profitability and ROE and maintain strong operational performance,” he added. He pointed out that the solid financial performance achieved by KFH during the previous period helped it take the leadership of local banks in many financial indicators. For example, KFH ranked first in Kuwait in terms of market capitalization on MEED’s list of the MENA’s top 100 listed companies. Also, KFH achieved the highest profitability ratios among the Kuwaiti banks, enjoying large franchise and good capitalisation.

Strengths

Emphasizing the successful digital transformation strategy, Al Rushood said that the smart banking services strengthened KFH`s uniqueness in providing distinguished and exclusive banking services and products such as KFHGo which helped meet the growing needs of customers. Also, KFH’s banking solutions keep abreast of the latest innovations and the highest quality-standards, adding high value to the experience of customers who expect fast and easy services.

Sustainability

Al Rushood pointed out the pioneering social role of KFH and its contributions to many strategic initiatives, most notably signing an agreement with the Kuwait Red Crescent Society (KRCS) to implement relief and medical projects in cooperation with the Jordan Red Crescent Society, and two agreements with the King Hussein Cancer Foundation and KRCS to treat cancer patients, in addition to many environmental, youth and sustainable initiatives

Developing human resources “As part of the importance KFH attaches to supporting and encouraging its employees, the Bank has recently launched “Gadha” program to recognize their contributions in developing the institution and achieving the highest level of customer satisfaction. Also, KFH honored the graduates of Harvard Executive Development Program, titled “Leading in a World Transformed” as part of (Kafa’a) initiative launched by Central Bank of Kuwait (CBK) in collaboration with the Kuwaiti banks and organized by Institute of Banking Studies (IBS)”, Al Rushood said.

Global appreciation

Al Rushood expressed his pride of the global appreciations KFH has recently received by winning several prestigious awards, the latest of them were three awards for best Sukuk issuances of a financial institution by EMEA Finance. He said that these new awards reflect the achievements and successes KFH made in the Islamic finance industry, and its high efficiency that enabled it to play a prominent role in developing the Sukuk market. In conclusion, Al Rushood expressed his appreciation for the trust of shareholders and customers and the support of the Board of Directors, andpraised the role of regulatory authorities and the efforts of employees and all partners and stakeholders. He also stressed KFH’s pursuit of enhancing customer experience and maintaining leadership in Islamic financial services industry.