25/10/2020

25/10/2020

United States

Joe Biden Leads in Election Polls The final US presidential debate took place last Thursday and presented few surprises for voters. Unlike the first chaotic debate, the threat of a mute button seemed to restrain the candidates this time around. Democratic nominee and former vice-president Joe Biden remains ahead even as his lead narrows in some key states. The November 3rd election day is nearing, reinforcing investor caution.

A Pandemic Record Low: Jobless Claims Fall Below 800K Additional filings for jobless claims in the US totaled 787K last week versus the 875K expected, nearly the lowest total since the start of the COVID-19 pandemic. The figures are far from the weekly peak seen in March at 6.9 million. Continuing claims also declined, dropping by 1.02 million to 8.37 million – also the lowest since March. However, what must also be taken into account is that some long-term unemployed workers have lost eligibility for such programs which are typically capped at 6 months. Data reveals a separate program offering similar benefits rose by 3 million this month alone. Meanwhile, it appears unlikely that Republicans and Democrats will agree on a stimulus relief package prior to the elections. The economy has not been supported by any stimulus other than the over $3 trillion injected in March and April.

Europe & UK Double-Dip Recession?

A second wave of COVID-19 has swept the European continent, amplifying expectations of a double- dip recession. With manufacturing benefiting from stronger global demand, the services sector has struggled to remain active as consumers are forced to stay home and businesses shut down once again. The Eurozone’s flash manufacturing PMI rose to 54.4 from 53.0, while the services PMI deepened in the contraction territory at 46.2 following 47.1. The data echoed similarly in France and Germany, with manufacturing rising to 51 and 58 respectively. Meanwhile, services registered at 46.5 for France and 48.9 for Germany.

Britain to Resume Trade Talks with EU

Negotiations between the EU and UK regarding a Brexit agreement have resumed with the aim of reaching a deal by mid-November, according to Britain’s chief negotiator David Frost. Diplomats will aim to strike a deal in time for it to be implemented before Britain’s departure on December 31st. Without an agreement, the UK will abide by WTO rules and will be hit with tariff and quota costs. The two biggest roadblocks facing negotiators remain to be access to British fishing waters and the level competitive playing field. “Hard work needed,” European Commission President Ursula von der Leyen said in a tweet. “No time to lose.”

UK Inflation Ticks Higher

Annual inflation in the UK accelerated in September, just after the expiry of a government program that cut the bill for dining out. Consumer prices rose 0.5% y/y in September, compared with a 0.2% gain the month prior. The rise was driven mainly by higher transportation and restaurant costs, and followed the end of the “Eat Out to Help Out” program. Despite the tick-up in prices, inflation has remained well below the BOE’s 2% target since April.

BOE: Risks are “Heavily Skewed to the Downside”

In reaction to the COVID-19 pandemic, the Bank of England has expanded its asset purchases program while cutting the benchmark interest rate twice to 0.10% from its previous 0.75%. During its September meeting, monetary policy was kept unchanged and the target for purchases of government and corporate bonds was unchanged at GBP 754 billion. The record low rate has left little headroom to spur inflation, and financial markets predict interest rates may turn negative within the next 12 months. BOE governor Bailey has claimed that negative interest rates are in the Bank’s “box of tools” but insisted the policy is not close to being adopted. “We’re operating at an unprecedented level of economic uncertainty. Of course, that is heightened now by the return of COVID…The risks remain very heavily skewed towards the downside,” he added. Britain’s economy shrank by 20% during Q2 of 2020, marking the biggest drop among advanced economies.

Asia China’s Swift Recovery Provides Hope

Unlike global peers, China’s economy has continued to recover from the coronavirus slump, evident by the 4.9% q/y growth in GDP seen in Q3 of 2020. Retail sales and industrial production gained significant momentum, rising 3.3% and 6.9% respectively on a yearly basis. Though expectations were for a stronger GDP figure, the economy is clearly on a path to robust recovery. Nevertheless, the risk of another wave of infections – already witnessed in the Eurozone and the US – will continue to threaten the recovery given the Chinese economy’s strong reliance on global demand. Policymakers across the globe are eager to see a robust recovery in the world’s second largest economy. Central Bank Governor Yi Gang said last week that China has “pro-active fiscal policy” and “an accommodative monetary policy to support the economy.” Yi continued to voice strong optimism, adding that “the Chinese economy remains resilient with great potential. Continued recovery is anticipated which will benefit the global economy.” The IMF now forecasts an expansion of 1.9% for the year, close to the PBOC’s own projection of 2%. This would make China the only major economy to report growth in 2020, at the same time marking the slowest annual pace since 1976.

Commodities

World Bank Predicts Oil will Average $44 in 2021 Understandably, oil prices have suffered the greatest among commodities due to the pandemic. While metal and agricultural commodities have recouped a significant amount of losses, energy prices will likely continue to struggle. The World Bank expects oil prices to average $44 per barrel next year, barely higher than the expected average of $41 a barrel this year. In contrast, the 2019 average oil price level sat at $61 a barrel. “High levels of inventories are expected to continue to unwind over the forecast, and will keep oil prices below $50 until 2022,” the World Bank said. On the demand side, COVID-19 poses the greatest risk, while the return of Libyan production is a risk on the supply side. Investors will watch closely for the potential of OPEC+ not easing the cuts from January as planned. However, this will pose a significant threat to oil producers who were hit hard by the oil price crash. Towards the end of last week oil prices rallied on the idea, following Russian President suggesting OPEC+ could roll back the easing of production cuts if necessary.

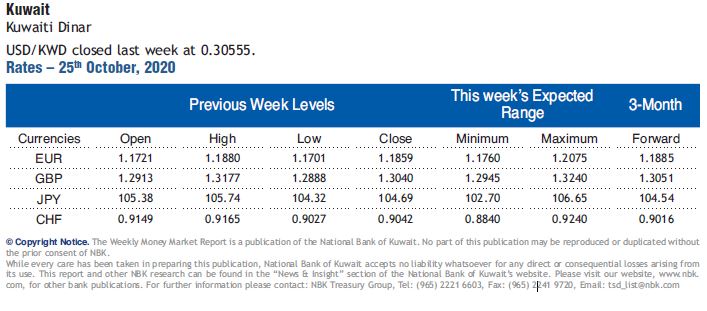

Kuwait

Kuwaiti Dinar USD/KWD closed last week at 0.30555. Rates – 25th October, 2020