19/01/2026

19/01/2026

BANGKOK, Jan 19, (AP): US stock futures skidded Monday after US President Donald Trump threatened to slap a 10% extra tariff on imports from eight European countries because they oppose having America take control of Greenland. The European countries targeted by Trump blasted the move, saying his threats "undermine transatlantic relations and risk a dangerous downward spiral.”

An unusually strong joint statement from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands and Finland was the most forceful rebuke from the European allies since Trump returned to the White House almost a year ago. The future for the S&P 500 fell 0.9%, while that for the Dow Jones Industrial Average was down 0.8%.

Trump's moves are testing the strategic alignment and institutional trust underlying support from Europe, the largest trading partner and provider of financing to the United States, Stephen Innes of SPI Asset Management said in a commentary. "In a world where geopolitical cohesion within the Western alliance is no longer taken for granted, the willingness to recycle capital indefinitely into US assets becomes less automatic.

This is not a short-term liquidation story. It is a slow rebalancing story, and those are far more consequential,” Innes said. In Asia, shares were mixed after China reported that its economy expanded at a 5% annual pace in 2025, though it slowed in the last quarter. Oil prices edged higher. Strong exports, despite Trump's higher tariffs on imports from China, helped to offset relatively weak domestic demand.

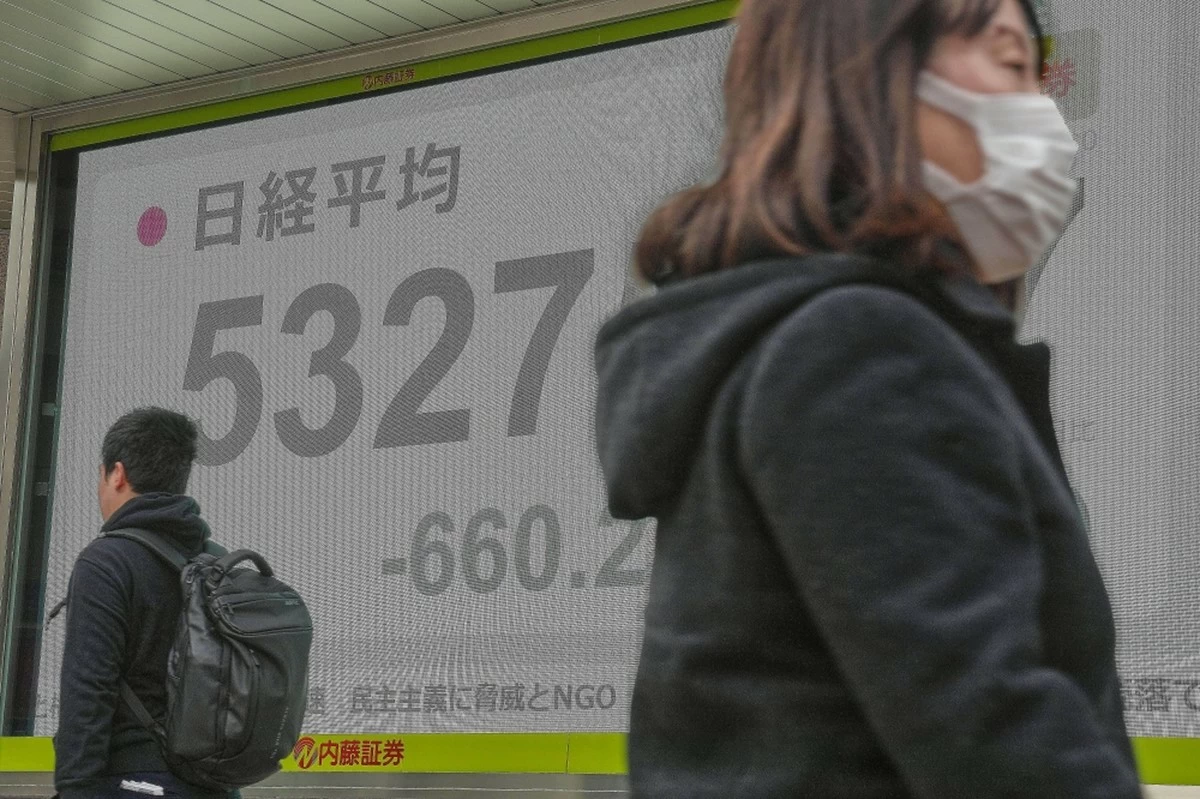

Hong Kong's Hang Seng index lost 1.1% to 26,563.90. The Shanghai Composite index gained 0.3% to 4,114.00. In Tokyo, the Nikkei 225 declined 0.7% to 53,583.57. Japanese Prime Minister Sanae Takaichi was due to hold a news conference later Monday as she prepares to dissolve the parliament for a snap election next month.

Elsewhere in Asia, South Korea's Kospi jumped 1.3% to 4,904.66, pushing further into record territory on strong gains for tech-related companies. Computer chip maker SK Hynix climbed 1.1%. Taiwan's Taiex added 0.7%, while the Sensex in India fell 0.6%. On Friday, stocks edged lower on Wall Street as the first week of corporate earnings season ended with markets trading near record levels.

The S&P 500 fell 0.1% and the Dow industrials lost 0.2%. The Nasdaq composite shed 0.1%. They all notched weekly losses, while smaller company stocks fared better. The Russell 2000 eked out a 0.1% gain. Technology stocks were the strongest forces behind the market's moves throughout most of the day. Several big technology stocks made strong gains and helped offset losses elsewhere.