11/02/2026

11/02/2026

BANGKOK, Feb 11, (AP): Shares were moderately higher in Asia on Wednesday after US stocks drifted to a mixed finish following a discouraging report on how much money US retailers made during the holidays. US futures edged higher and prices of gold, silver and oil also advanced. Markets were closed in Japan for a holiday. Chinese markets crept higher, with the Hang Seng in Hong Kong up 0.3% at 27,260.35.

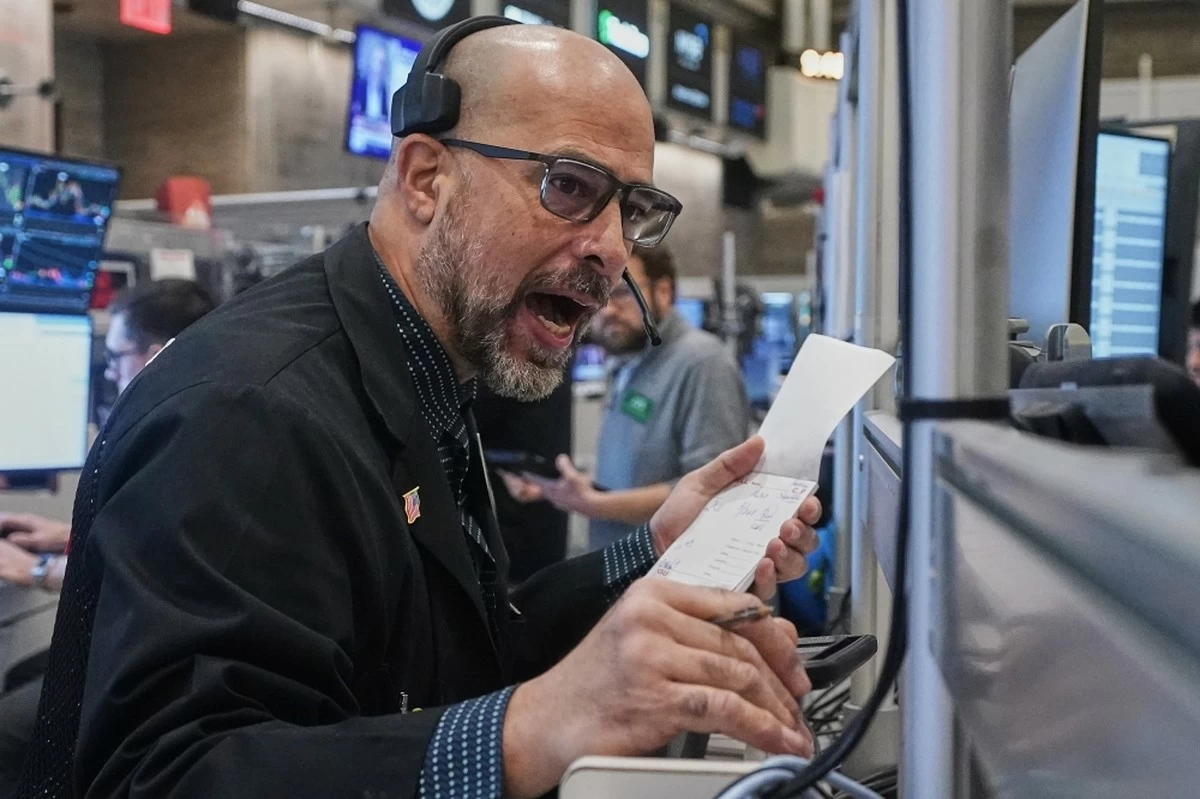

The Shanghai Composite index added 0.1% to 4,133.46. In South Korea, the Kospi extended its gains, rising 1% to 5,346.34. Australia's S&P/ASX 200 climbed 1.7% to 9,014.80, while Taiwan's Taiex jumped 1.6%. On Tuesday, stocks drifted on Wall Street following a mixed set of profit reports from big US companies.

Hopes rose that the Federal Reserve will cut interest rates later this year to boost the economy following a discouraging report on US shoppers' appetite for spending. "Fresh data points to softening USconsumer momentum since last December as wage growth cools and household credit stress builds,” Mizuho Bank said in a commentary.

It noted that demand weakened in eight of 13 categories, including clothing and furniture. The S&P 500 fell 0.3% to 6,941.81 after briefly rising above its all-time high set a couple weeks ago. The Dow Jones Industrial Average added 0.1%, to its own record, closing at 50,188.14. The Nasdaq composite fell 0.6% to 23,102.47.

The action was stronger in the bond market, where Treasury yields fell after a report showed US retailers made less money at the end of last year than economists expected. That could signal slowing spending by US households, the main engine of the economy.

More reports are coming this week. On Wednesday, the US government will give the latest monthly update on the unemployment rate, while a report Friday will show how bad inflation is for US consumers.

Altogether, the data should help the Federal Reserve decide what to do with interest rates. The Fed has put its cuts to interest rates on hold, and too-hot inflation could keep it on pause for a long time. But a weakening of the job market, on the other hand, could push it to resume cuts more quickly.